By TJ Strydom and Wendell Roelf

CAPE TOWN (Reuters) – Africa’s biggest grocery retailer Shoprite is considering a push into Eastern Europe, where it hopes to use knowledge gleaned from former suitor Steinhoff International, its new CEO told Reuters.

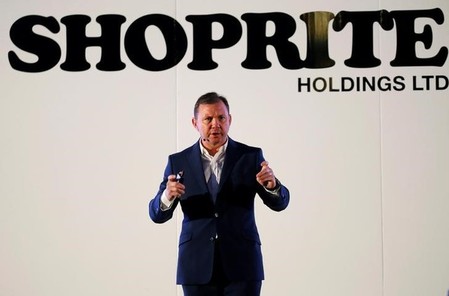

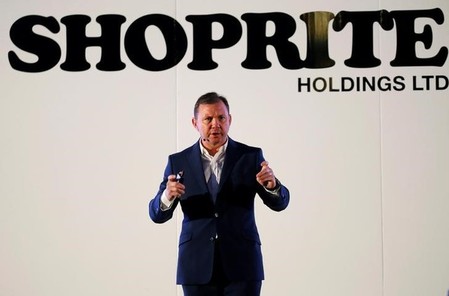

The move signals a change in strategy for Shoprite under Chief Executive Pieter Engelbrecht, 47, as sovereign rating downgrades and a weak economy cloud prospects at home. It also leads it down a competitive path crowded with established retail giants such as Tesco, Carrefour, Lidl and Aldi .

Engelbrecht, who took over from 37-year veteran Whitey Basson in January, said the company wants to enter markets in Eastern Europe that either “have low competition or high economic growth”.

Shoprite has grown rapidly over the past two decades as shoppers from Lagos to Luanda increasingly shunned street markets and spent more of their wages in formal retail stores, but still less than 20 percent of its sales are outside its home market.

“We will look at other developing countries. That is also something that came out with our Steinhoff discussions and they’ve got good presence there, so we would like to leverage off that knowledge and definitely have a look at the East Bloc countries,” he said in an interview at the company’s head office outside Cape Town.

Steinhoff in February called off a plan to merge its African clothing and furniture assets with Shoprite’s stores, a deal bankers had said could create a giant valued at more than 180 billion rand ($13 billion).

“The two types of entry countries that you look at is either one with low competition or you look at one with high economic growth,” he said, adding that a trip to the region was planned although he did not say which countries he was considering.

“We will go slow. We are not going to over commit ourselves to learn if the market accepts us. So we will first establish a couple of stores and make sure the market likes us, and if we find acceptance then one can look at a merger or acquisition.”

However, a move to Eastern Europe would be fraught with risks and would not likely provide the profits necessary to offset the impact of reducing its exposure to the impact of credit ratings downgrade on South Africa, analysts said.

“So whatever ratings uplift one can expect from reducing South African exposure, might well be given up on lower profit margins and execution risk from such an acquisition,” said Unathi Loos, an Investec Asset Management retail analyst.

But Shoprite’s experience in selling to low income earners in far-flung cities across Africa could help it mount a strong challenge.

The company is also pondering a move into the South American market, Engelbrecht said.

SOUTH AFRICA

Engelbrecht, a chartered accountant who – before a serious neck injury – had dreams of playing rugby professionally, said Shoprite was maintaining sales and customer growth in South Africa and should reach its profit targets this year, but was concerned that a weaker rand currency could hurt consumers.

South Africa’s rand was the worst performing emerging market currency this month, retreating more than 10 percent against the greenback, as the shock of a midnight cabinet reshuffle and subsequent credit ratings downgrade weighed on sentiment. [

Engelbrecht said Shoprite had a strong balance sheet to help weather the volatile rand and was talking to banks to raise between 10 billion and 15 billion rand for its capital requirements over the next six years.

Though raising funds in South Africa is likely to be more costly due to the downgrades, Shoprite can still tap foreign markets through its structures in Mauritius.

And raising funds in Eastern Europe could be significantly cheaper than in South Africa, analysts said.

($1 = 13.6146 rand)

(Editing by Louise Heavens and Susan Thomas)