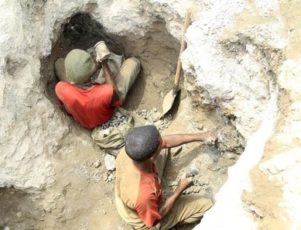

KOLWEZI, Democratic Republic of Congo (Reuters) – His toes bursting out of sneakers several sizes too small, a miner hacks with a pick at the copper and cobalt-laced stone in southeastern Congo, slowly filling a sack that could earn him anywhere from a handful to a few hundred dollars.

The 42-year-old father of five, who only gave his first name, Stany, has done this nearly every day for a decade, after he quit his maize fields for the comparatively lucrative mines of Africa’s top copper producer.

But unlike most artisanal mining, this is sanctioned by the Congolese government. As its mining heartland endures mass layoffs at big mines caused by low commodity prices, small-scale mining is helping to fill the deficit.

The price of cobalt, a byproduct of copper, is expected to rise 45 percent by 2020 owing to demand for electric vehicles. Congo holds about half the world’s cobalt reserves.

Seizing the initiative, the national mines ministry has recognised dozens of cooperatives of workers to exploit 10 square kilometre plots of land owned by state miner Gecamines.

Tens of thousands of people also dig near mines owned by giants like Glencore and Eurasian Resources Group, as more than 13,000 jobs have been shed in the formal sector.

Yet, as is often the case, poor local diggers say that it is savvier, well-capitalised foreign buyers who are cashing in. They accuse Chinese and Lebanese middlemen of dominating the market by colluding to drive down prices and rigging their instruments to understate the weight and tenor of ore they buy.

That could store up trouble if discontent turns into unrest, as happened in past years in Zambian copper mines, when workers beat up and killed Chinese mine managers in pay disputes.

At the Musompo market, a smattering of half-built brick and concrete depots 15 kilometres east of Lualaba province’s capital of Kolwezi, miners and traders said that of the roughly 140 buying firms, almost all are Chinese owned.

COOPERATIVES

Lualaba Governor Richard Muyej would rather see farming and tourism, which he considers paths to more inclusive, sustainable development but reluctantly accepts the need to expand small mining in the near term.

Muyej said giving cooperatives measuring instruments would help level the playing field between miners and foreign buyers.

Alain Chinois, the Congolese president of a cooperative with 34 members, said he might be forced to turn to foreign investors to secure the necessary funding. Under his set up, diggers will receive 60 percent of revenues from the mine while cooperative members consisting of Congolese traders running them and an investor — likely Chinese or Lebanese — would split the rest.

He said the cooperatives would result in better working conditions, equipment and access to capital.

“As a cooperative, we can go to a bank as a well-established group,” said Chinois. But he acknowledged that foreign buyers with money to invest would continue to exert major influence.

At Musompo, Louis, a Chinese buyer who checked London Metal Exchange prices on his phone between deliveries, sells to a smelter owned by Congo Dongfang Mining International (CDM), a wholly-owned subsidiary of Chinese mineral giant Zhejiang Huayou Cobalt Ltd, China’s top cobalt chemicals producer.

According to a January report by Amnesty International, CDM exports to China before selling to battery manufacturers who claim to supply electronics companies including Apple, Samsung SDI and Sony.

Hearing miners’ complaints, Louis shrugged: “Those who are happy with the price sell the product. Those who aren’t, leave.”

And the old concerns about the dangers and abuses of artisanal mining haven’t gone away. At the Tilwizembe mine where Stany works, despite its cooperatives, research by Amnesty in 2013 documented deadly accidents and abuse of workers.

But whatever its flaws, few see a viable alternative to more small-scale mining in the near term.

“I do this because there is nothing else. If something else came along, I would do it,” Stany said.

(By Aaron Ross. Reporting by Aaron Ross; editing by Susan Thomas)

Read more