Over the past decade, the Middle East and North Africa (MENA) region has witnessed a dramatic rise in financial technology startups. These companies are redefining the way individuals and businesses interact with money, from mobile wallets to cryptocurrency exchanges and instant credit services. With growing smartphone usage, increasing internet penetration, and government support, fintechs are playing a vital role in driving financial inclusion and modernizing the economy across countries such as the United Arab Emirates, Saudi Arabia, Bahrain, Egypt, and Jordan.

One of the key players in this digital shift is Ziina, a UAE-based app that enables peer-to-peer payments without traditional bank account details. It caters to a younger, mobile-first generation seeking fast and intuitive money transfer solutions. In Saudi Arabia, Tamara has become one of the fastest-growing Buy Now, Pay Later platforms in the region, partnering with major brands and attracting international investment. Bahrain’s Rain, one of the first licensed cryptocurrency exchanges in the Gulf, is pioneering digital asset adoption in a region traditionally cautious about decentralized finance.

Egypt has emerged as a fintech powerhouse in North Africa. Companies such as Fawry, Paymob, and Khazna are offering everything from mobile payments to microloans, targeting both consumers and small businesses. With more than 60 percent of its population still outside the formal banking system, Egypt presents massive growth potential for fintech. The government has also been supportive, implementing new policies to accelerate digital financial inclusion.

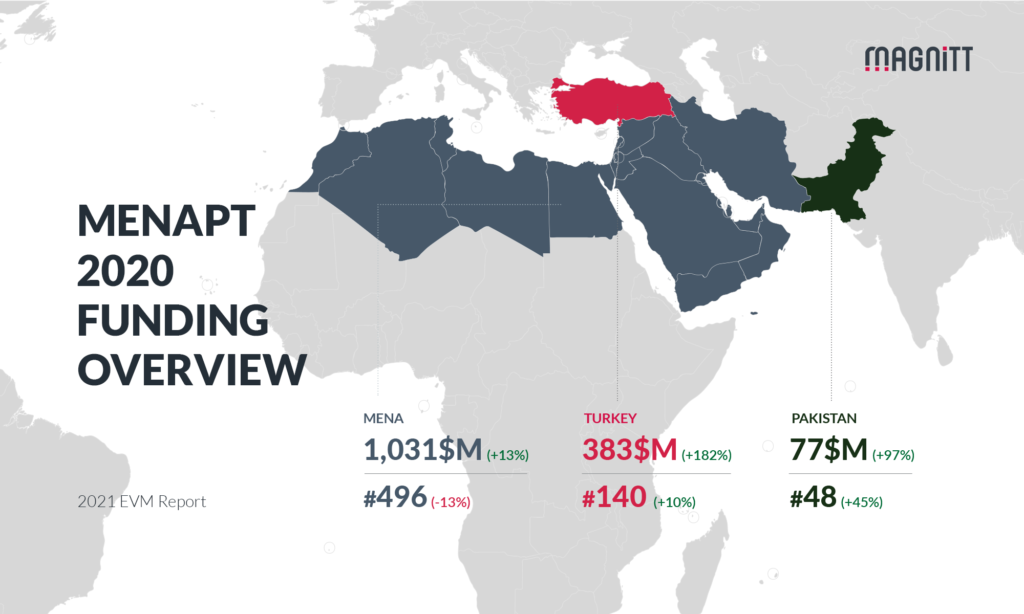

Regional venture capital investment reflects the enthusiasm. In 2024, MENA-based fintech startups raised over 3 billion dollars, marking a significant rise from previous years. Public initiatives like Saudi Arabia’s Vision 2030 or the UAE’s financial innovation hubs in Abu Dhabi and Dubai are also reinforcing this ecosystem, attracting both local and international startups to test and scale their products.

Controversies and Regulatory Risks in the MENA Fintech Sector

Despite the success stories, the fintech boom in MENA is not without its critics. Key concerns revolve around data privacy, regulatory gaps, and financial ethics. As fintech platforms handle increasingly large volumes of sensitive personal and financial data, experts warn of potential misuse, especially in jurisdictions where data protection laws are weak or inconsistently enforced. Questions about who has access to user data, how it is stored, and what third parties are involved remain largely unanswered in many cases.

The Buy Now, Pay Later model has come under growing scrutiny as well. While it provides accessible short-term credit, consumer protection advocates in the region have raised alarms about unclear terms, hidden fees, and a rising number of defaults. There are fears that BNPL could encourage overspending and indebtedness, particularly among young users with limited financial literacy. Several regulators are considering tighter oversight or new licensing requirements to mitigate these risks.

Another challenge is ensuring that fintech actually benefits the financially excluded. Many apps and services remain urban-focused, requiring access to smartphones, stable internet, and a minimum level of tech literacy. As a result, rural populations, older adults, and women in conservative areas may still face barriers, reinforcing rather than reducing inequality.

The MENA region’s fintech revolution is at a critical juncture. While its potential to reshape the financial landscape is undeniable, its future will depend on how well it addresses concerns around privacy, regulation, and inclusivity. A sustainable ecosystem must balance innovation with accountability and access for all.

Photos : arageek.com