Japan plans to support 60 projects in Africa as preparations get under way for the sixth Tokyo International Conference on African Development in Kenya in August.

Japan plans to provide development aid for 60 projects in Africa as it seeks to take part in the economic growth of the continent while countering the increasing presence of China.

The Japanese commitment is expected to be announced at the Tokyo International Conference on African Development in Nairobi, Kenya in August. The conference is sponsored by Japan, the United Nations and the African Union.

The total dollar amount of the assistance has not been determined. However, the Japanese aid will focus primarily on infrastructure development in the area around Mombasa port in Kenya, around Nacala port in northern Mozambique, and developments in Ivory Coast and surrounding West African countries.

In addition to port infrastructure and roadwork, the projects include development of an urban transportation network in Nairobi and development of natural gas extraction capabilities in Mozambique.

Program will distribute testing equipment

In Zambia, the Japanese will fund a program to distribute medical testing equipment in the wake of the Ebola outbreak. A student exchange program and a microloan project also are under discussion.

Japan has a history of significant aid and investment in Africa and has been the largest Asian source of investment in the continent.

Japanese development assistance to Africa nearly doubled from $1 billion in 2007 to USD 1.8 billion in 2012. In the private sector, Japanese companies accounted for $3.5 billion in 2014, more than 80 percent of the total private investment from Asian countries.

Japanese investors show interest in Africa

One investment expert says interest from private Japanese investors is growing.

“It is clear there is significant and increasing interest both in terms of the government and the trading houses in looking at Africa and Sub-Saharan Africa in particular. The Japanese see Africa as an important and inevitable market and, as with other emerging markets, it is somewhere that they need to be,” said Andrew Skipper of the London law firm Hogan Lovells.

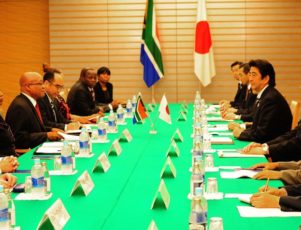

The Japanese government has encouraged and attempted to facilitate private Japanese investment in Africa. For example, during his 2014 visit to Africa, Japanese Prime Minister Shinzo Abe was accompanied by trade delegations from his country and pushed the idea of more Japanese private investment in the continent.

At a Japan-African Ministerial Meeting for Resources Development in Tokyo in May,

Yoichi Miyazawa, the Minister of Economy, Trade and Industry, said the government wanted to take trade with African states “to a new stage.” A government statement added: “Japan aims to expand opportunities to bring about a mid-to-long term stable supply of mineral resources from Africa.”

Competition with China

The meeting also brought into focus the competition among investors from different nations. Martin Kabwelulu Lablio, mining minister of the Democratic Republic of Congo, told attendees that China had committed $6 billion in investment in mining and infrastructure. Lablio encouraged Japanese investors to follow suit. “We want Japan to surpass this number,” he said.

As it seeks to raise its profile and its influence in the region, China has stepped up its investment in the continent, mostly through loans from Chinese banks rather than direct aid.

With its need for minerals and to gain footholds in strategic locations for its “one belt, one road” policy of creating trade routes to the West, China has issued a string of announcements about large investments on the continent.

For example, China has announced plans to build a naval base in the Horn of Africa nation of Djibouti. Other plans, with a price tag of $12.4 billion, include expansion of port facilities, two new airports, as well as a $4 billion rail link with Ethiopia, Djibouti’s land-locked neighbor.

Chinese bank pledges funds

According to one report, China heads the list of state-run development financiers, with the Export-Import Bank of China pledging $1 trillion in the next decade. Chinese institutions are the largest source of funds for infrastructure in Africa, accounting for $13.4 billion in 2013.

In December 2015, China pledged investment of $60 billion in Africa over three years, with most of it in the form of loans or export credits. However, China’s investment in Africa also declined by 40 percent last year as the Asian nation’s economy slowed.

Analysts said the change in China’s investment also might reflect a decrease in the nation’s need for minerals from Africa.

China is Africa’s largest trading partner. Trade both ways totaled $220 billion in 2015, with China primarily receiving minerals from Africa in exchange for manufactured goods.

Conference first in Africa

Japan seeks to rival the Chinese with increased investment in the continent.

The sixth Tokyo International conference is the first to be held in Africa. Previously staged in Japan every five years since 1993, but will now be held every three years and the Africans have been encouraged to take ownership of the process.

Japanese Prime Minister Shinzo Abe is expected to announce the 60 aid projects during the Nairobi conference Aug. 27 and 28.

The Japan-Africa partnership is not without friction. In 2013, Japan announced financial assistance of $32 billion but African officials note that so far only about 20 percent has been disbursed. The Japanese, meanwhile, want to see appropriate technology and training in place before they commit more funds.

Read more