PRETORIA (Reuters) – South Africa’s central bank cut its main interest rate to 6.5 percent on Wednesday, in another boost for the economy after ratings agency Moody’s left intact its last investment-grade credit rating.

Traders and economists had expected the 25 basis-point cut in the repo rate after a slowdown in consumer price inflation to 4.0 percent in February, which put price growth well within the central bank’s 3-6 percent target range.

It was the first easing step since July and comes as South Africa rides a wave of investor optimism in the wake of President Cyril Ramaphosa replacing scandal-plagued Jacob Zuma as head of state in February.

The rand fell, however, as the rate cut dents somewhat the appeal of local assets versus developed-market peers. Banking stocks also fell.

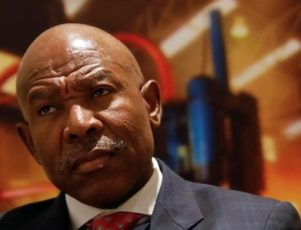

South African Reserve Bank Governor Lesetja Kganyago told a news conference that inflation risks had subsided somewhat since January and that the bank had raised its economic growth forecast for this year to 1.7 percent from 1.4 percent.

But he said that the bank had not started “a journey of cutting” and that the future path of the repo rate would depend on data.

Four members of the Monetary Policy Committee voted to cut the rate while three wanted to keep it on hold, Kganyago said. There was no discussion of a more aggressive 50 basis-point rate cut.

Despite the central bank’s broadly upbeat tone, Kganyago said that the growth outlook remained relatively constrained and that the policy-setting committee would prefer to see inflation expectations anchored closer to the midpoint of its target range.

Analysts said they were not expecting to see a flurry of further rate cuts.

Razia Khan, an Africa-focused economist at Standard Chartered, said: “We think that today’s 25 basis-point cut was probably it in terms of South Africa’s easing cycle”.

Moody’s said on Friday that it expected to see a strengthening of South Africa’s institutions under Ramaphosa which could translate into greater economic and fiscal strength.

S&P Global, another of the “big three” ratings agencies, said it wanted to see stronger per capita growth before it would consider raising its credit rating.

(Reporting by Olivia Kumwenda-Mtambo and Nomvelo Chalumbira; Writing by Alexander Winning; Editing by James Macharia and Hugh Lawson)