Leyja, NEOM’s latest sustainable tourism destination in Saudi Arabia, nestled between the Gulf of Aqaba coast and 400-meter-high mountains, exemplifies the kingdom’s commitment to a multifaceted, eco-friendly tourism industry under Vision 2030, offering three architecturally distinct hotels and curated experiences in a nature-reserve setting.

In a significant stride towards a more sustainable and diversified tourism industry, NEOM, Saudi Arabia’s futuristic super-city, has unveiled Leyja, its latest ecotourism destination.

Nestled along the Gulf of Aqaba coast and winding inland through a valley surrounded by 400-meter-high mountains, Leyja is a testament to Saudi Arabia’s commitment to sustainable development and its ambitious Vision 2030 initiative.

Where Is Leyja?

Leyja is strategically positioned to unfold from the Gulf of Aqaba coast, creating a natural valley that carves through the impressive mountains of NEOM.

What sets Leyja apart is its dedication to preserving nature, with 95% of its expansive landscape designated as a nature reserve.

This aligns with NEOM’s overarching strategy to blend innovative ecological design with construction techniques that integrate seamlessly with the environment.

A Strategic Step in Saudi Arabia’s Commitment

Leyja represents a strategic step in Saudi Arabia’s commitment to diversifying its tourism destinations and boosting its economy. As part of the NEOM super-city, this $500 billion development aims to attract discerning travelers with its ultra-luxurious offerings, including high-end stores, helipads, and fine-dining restaurants helmed by celebrity chefs.

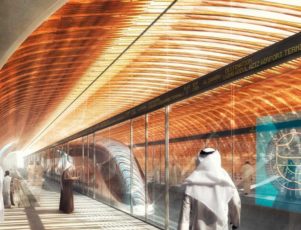

Led by renowned architects Mario Cucinella, Chris van Duijin, and Shaun Killa, Leyja’s architectural direction reflects a harmonious blend of luxury and sustainability. The development features three distinctive hotels, each offering a unique experience while staying true to its natural surroundings.

The “Adventure Hotel” (Chris Van Duijn) is a designed as a vertical structure with a deconstructed aesthetic resembling a cliffside staircase. It’s a hub for tourists seeking high-octane activities such as rock climbing. Its design minimizes impact on the natural terrain, allowing guests to engage with the rugged landscape

“Oasis Hotel” (designed by Mario Cucinella Architects) is emerging from the rocks with five facade fins, it serves as a gateway to exploration, offering panoramic views of the valley. The design mirrors the natural context, providing guests with an immersive experience that complements the breathtaking surroundings

The Wellness Hotel is a reflective retreat with two opposing volumes adorned with high-tech facades. This immersive wellness retreat complements Leyja’s commitment to holistic experiences, offering guests a serene escape amidst nature.

Experiences And Activities At Leyja

Leyja goes beyond traditional hospitality by curating refined experiences for visitors. Fine dining by world-renowned chefs, rooftop infinity-style pools, and wellness facilities are just a glimpse of what the destination has to offer.

For those seeking adventure, Leyja provides guided wadi walks, hiking trails, mountain biking, and climbing, allowing guests to immerse themselves in the dramatic mountain landscape.

Leyja stands as a beacon of sustainable luxury in the heart of Saudi Arabia’s mountains, inviting visitors to experience the beauty of nature without compromising on comfort. As the kingdom continues to invest in projects like Leyja, it not only aims to meet its tourism targets but also sets an example for environmentally conscious and innovative development on a global scale. With Leyja, NEOM is not just creating a destination; it’s crafting an ecological masterpiece that harmonizes with the natural wonders of Saudi Arabia.

Photos : zawya.com –