MIT brings MENA’s smartest minds together for a universally beneficial competition.

On April 14, the smartest technology-oriented minds from the Middle East and North Africa (MENA) will meet in the Kingdom of Saudi Arabia for the third and final round of the MIT Enterprise Forum Pan Arab competition. Organized by the renowned Massachusetts Institute of Technology (MIT), this forum brings together innovative minds from 21 Arab countries to change the way we think, learn and access services.

In its 9th year, this competition brings together MENA’s smartest innovators in four tracks: ideas, social entrepreneurship, start-ups and The Silicon Valley Program. This year, more than 5,000 applications were received from 21 countries in French, English and Arabic. All finalist teams will receive top tier coaching from leaders in their respective fields; networking opportunities with budding and well-known specialists and the opportunity to learn from others in their category. The top three finalists will receive, in order, US$15,000, US$10,000 and US$5,000 to turn their ideas into tangible reality.

Ideas Track

20 teams are short-listed for the “ideas” track. In order to be eligible, candidates must form a team of at least two people including at least one Arab national; are not required to have a working prototype of their invention; are forbidden from having any current sales; and are not required to be registered or incorporated in any way, but are required to incorporate a company in one of the Arab countries in order to win prize money; applicants may not have received any previous funding for their idea; and the idea can be in any industry–technology, food security, health delivery or otherwise.

Since the goal of this competition is to bring fresh ideas into the global marketplace, much of the judging criteria for this track is based on the feasibility of an idea. Teams are judged on three criteria.

Experience: the value each member adds to the team and the relevance of each team member to the incubation and development of the idea

Innovation: the creativity of the idea and whether or not it improves upon an existing solution/business process or introduces a new solution to a current challenge in any field

Scalability: the relevance of the idea to the global marketplace is judged on whether markets outside of team’s community would find the product useful. At a minimum, teams are expected to be relevant on a national scale, and should be replicable on a global scale.

Social Entrepreneurship Track

The Social Entrepreneurship track is similarly judged for eligibility. Teams must have a minimum of two members with at least one Arab national, the team must have a registered social enterprise either for or non-profit, the core product/service must address a specific social challenge faced by marginalized/disadvantaged peoples, and the enterprise can be in any industry.

The 20 finalist teams are judged on similar criteria as above, but with different details.

Innovation: the product/service must provide a new way to tackle the specific social challenge the team is addressing

Scalability: the social enterprise should not be limited to a local market, but should be scalable to the national level at a minimum. Preferably, the model could be expanded and replicated as the enterprise grows, where relevant.

Social Impact: the team will be judged on the efficacy of the project, and the extent to which it benefits the targeted population

Financial Sustainability: the team must prove that their enterprise is financially sustainable in the long-term for both for-profit and non-profit enterprises

Startups Track

30 teams will be selected for the second and final round of the Startups Track competition. These teams must be comprised of a minimum of two members, one of whom must be Arab, must have a working prototype of their startup, must already generate more than $500,000 in revenue, must have been in operation for no more than 5 years, must be legally registered in any Arab country and the start-up may be in any industry.

The teams will be judged on the following:

Team: judges score teams based on their individual experience, the value added by each person and the relevance of each role

Innovation: the start-up will be assessed for creativity, and whether it replicates an existing product/service

Scalability: the start-up must be relevant outside of the local context and should be easily replicable in other relevant fields, regardless of location.

The Silicon Valley Program

Unlike the above tracks, the Silicon Valley Program competition will finish in September, when finalists receive a much more comprehensive and hands on package than the other finalists. The Silicon Valley Program brings entrepreneurs from 20 start-ups to Silicon Valley (in northern California, United States) for a week-long immersive program. Finalists will attend and participate in conferences and workshops with some of Silicon Valley’s most successful start-ups and learn how to successfully “pitch” ideas to funders. Mentors include current industry leaders as well as members of the Arab diaspora who are better able to speak to the specific challenges entrepreneurs from the MENA region face.

This program accepts a higher-level of start-up teams than the other tracks. Start-ups must have been in operation for more than two years, must have global or regional reach/presence, must have successfully completed one round of fundraising and must have more than $500,000 in revenue per annum.

The Rising Tide

Competitions like this provide an incredible opportunity for young, successful and intelligent people to gather and share ideas. Not only do they have the potential to receive funding to scale up their operations to the global level, but they receive invaluable exposure and mentorship opportunities. Previous winners include Visualizing Impact, a Lebanese social enterprise that operates a citizen data laboratory to share science, design and technology data for social justice outside of formal channels; Kotobna, an Egyptian team that provides alternate means for young Arab authors to publish and monetize their written work and Screen DY, a Moroccan team that created a platform for users to quickly build complex, culturally relevant apps for all mobile technology platforms.

This competition is an important hallmark for young Arab entrepreneurs. Benefitting from the experience of others while gaining exposure to other like-minded people can invaluably change the way people in the MENA region and beyond access knowledge, share information and obtain products.

Clearly, there is an appetite for video games in Iran, especially among young people who make up such a large share of the total population. A

Clearly, there is an appetite for video games in Iran, especially among young people who make up such a large share of the total population. A

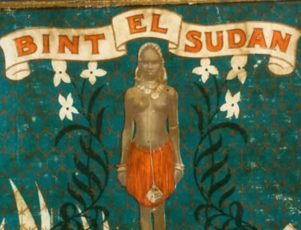

Bint el Sudan was created in the 1920s when, according to legend, fourteen leaders of Arab tribes approached a British traveler and adventurer, Eric Ernest Burgess, in Khartoum and asked him to create a fragrance. The perfume was developed in six months in the lab of Burgess’ employer, W.J. Bush & Co. in London.

Bint el Sudan was created in the 1920s when, according to legend, fourteen leaders of Arab tribes approached a British traveler and adventurer, Eric Ernest Burgess, in Khartoum and asked him to create a fragrance. The perfume was developed in six months in the lab of Burgess’ employer, W.J. Bush & Co. in London.