As talks fail to produce a peaceful solution, the standoff between rival parties has disrupted trade and brought international concern about potential violence.

The government of Zanzibar has announced plans for new elections in February but the opposition, which claims it won a previous vote that the government annulled, is calling for a boycott.

The announcement is the latest development in a nearly three-month political standoff that has disrupted trade in the east African archipelago and prompted international concerns about potential violence.

At the center of the controversy are long-running tensions over the balance of power between Tanzania on the mainland and tiny Zanzibar, which is a semi-autonomous state within the larger nation.

The leading players are Zanzibar President Mohammed Shein of the Chama Cha Mapinduzi political party, which holds power in both Tanzania and Zanzibar, and Maalim Seif Sharif Hamad, secretary general of the Civic United Front, the main opposition party in Zanzibar.

Opposition declared election victory

Hamad, who is also first vice president of Zanzibar, ran against the incumbent Shein in an October 25 election. The day after the vote, the opposition leader claimed victory before the results were officially announced.

Despite strong objections from the opposition and international observers who said the election was valid, the government annulled the election after the Zanzibar Electoral Commission determined there were electoral law violations.

While incumbent Shein and the Chama Cha Mapinduzi party support a new election, Hamad and the opposition party favor completing talks that began after the opposition questioned the legality of Shein staying in office after his term expired in early November.

Despite eight closed-door meetings since the election, negotiators have not come up with an agreement. Those taking part in the former Tanzania mainland president Jakaya Kikwete, former Zanzibar president Abeid Karume, and former Tanzanian president Ali Hassan Mwinyi in addition to Shein and Hamad.

Zanzibar economy suffers

The announcement of a new election comes in the face of international and domestic pressure to end the political impasse, which is hurting Zanzibar’s economy.

Beans, potatoes and tomatoes, which are from mainland Tanzania, have become scarce and increasingly expensive in Zanzibar. Tanzania’s government said mismanagement by traders, poor infrastructure and red tape are to blame, but Zanzibaris fear traders are responding to the political uncertainty.

According to the Bank of Tanzania (pdf), Zanzibar’s imports dropped by nearly half between October and November 2015, from nearly $40 million to $21 million.

At the same time, fears that the stalemate would affect tourism to the islands may have been unfounded. The bank reported that tourist arrivals increased in 2015, with earnings of $73.6 million, up from $55.2 million in 2014, a gain of more than 30 percent.

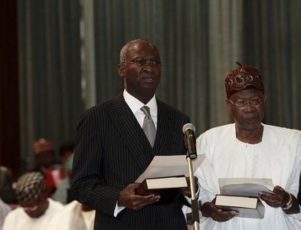

Maalim Seif Sharif Hamad, secretary general of the Civic United Front

Stalemate raises fears of radicalization

International observers declared the October election valid and called on the government to announce the results. They cited fears that the political stalemate could contribute to the radicalization of youths in Zanzibar, which is predominantly Muslim.

International observers also questioned the decision to annul the election, saying it appeared the election commission did not have a quorum when it made the findings of election violations. Nicodemus Minde, an election observer and adviser for Norwegian-based policy group International Law and Policy Institute, called the decision to annul “unilateral.”

The Chama Cha Mapinduzi party has long maintained power in Tanzania, while Zanzibar has chafed at what it considers mainland meddling. The opposition Civic United Front has called for full autonomy for Zanzibar.

After gaining independence from the British in 1961, Tanzania was formed in 1964, uniting the mainland Tanganyika state with the Zanzibar (also called Unguja) and Pemba islands.

Long history of political violence

Elections have been marked by clashes between the two parties since the 1990s, and hundreds have died in past elections. A unity government with the Civic United Front as the junior partner was formed in 2010, when Shein was first elected president, to diffuse tensions.

However, there were reports of police intimidation prior to the October election and two homemade bombs exploded in Zanzibar after the election was annulled. A third device was found and safely detonated in Stone Town, a popular tourist area.

In spite of the annulment, the ballots of 500,000 Zanzibar voters were counted in the election for Tanzania’s president. John Magufuli, the candidate of the Chama Cha Mapinduzi, received 58 percent of the total vote of 15 million and has been sworn into office along with Samia Suluhu Hassan, a Zanzibari who became Tanzania’s first female vice president.

New election “inevitable”

Meanwhile, the Zanzibar government said it had budgeted $3.4 million for a new election. Seif Ali Idd, Zanzibar’s second vice president, called a new election “inevitable.”

Idd said the ongoing talks with the opposition were aimed at keeping the peace but did not preclude an election.

Opposition spokesperson Ismail Jussa told supporters to ignore the government announcement, saying the talks should be completed before an election was scheduled.

It was not immediately clear when mediation talks would continue. Before the election announcement, former Nigerian president Goodluck Jonathan had been tapped to lead new talks and he was expected to visit the country early this year.

Renewed violence feared

The talks began after the opposition party raised questions about whether Shein could stay in office as president after his term expired in November. However, the government maintains that the Constitution allows him to remain in office until a successor is sworn in.

Hubertus von Welck, an election observer from the German Friedrich Naumann Foundation, said negotiations must continue to maintain the peace.

“If they cannot come to a diplomatic solution, we might once again see violence and deaths,” von Welck said.

In many cases it is easier for a traveler from an African country to first fly to Paris or Dubai and then to another African country, according to Fatima Beyina-Moussa, director general of Equatorial Congo Airlines and president of the African Airlines Association.

In many cases it is easier for a traveler from an African country to first fly to Paris or Dubai and then to another African country, according to Fatima Beyina-Moussa, director general of Equatorial Congo Airlines and president of the African Airlines Association.