According to a September study by the German real estate portal Lamudi, twelve African countries are among the Top 20 emerging markets where luxury real estate is most affordable. Ethiopia topped the ranking in a total of 32 emerging markets in the recent Lamudi results. Luxury real estate in Ethiopia now costs an average of 396.58 € per square meter. To put this in perspective, luxury Paris property such as the Place Vendôme, Tuileries, and Palais Royal real estate commands 13,000 € per square meter, according to This Paris Life. To extend the frame of reference, Global Property Guide reports an average cost of over 6,000 € per square meter for “affordable luxury” land throughout France. Amazingly, therefore affordable luxury real estate in France is roughly 15 times more expensive than luxury real estate in Ethiopia!

Out of phase with the Lamudi study, however, Global Property Guide reports that all land in Ethiopia is owned by the government of the country, and can only be leased. With continuing border disputes, and weak enforcement of property rights, it is not clear how investors can securely exploit this appealing valuation of real estate for commercial purposes in Ethiopia. And recent drops in currency values of many African countries already discourage investment. However, the broader picture is more appealing in some of the other countries featured in the Lamudi report.

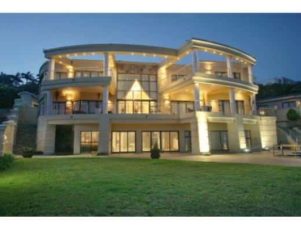

Côte d’Ivoire’s real estate market has grown rapidly since 2011

Côte d’Ivoire is now in full economic takeoff following a political and military crisis. Luxury real estate here is at an average price of 427.65 € per square meter, according to the Lamudi classification, which was made on the basis of average prices gathered from several thousand real estate sales advertisements. After ten years of sluggish economic growth, Côte d’Ivoire’s construction industry now claims double-digit growth in the most recent three years, according to the Oxford Business Group. Côte d’Ivoire’s real estate market has grown rapidly since 2011. Private initiatives thrive and the market is seeing significant development. A number of unique sources contribute to these especially attractive property prices. Substantial support by international donors in Côte d’Ivoire has artificially subsidized the markets and the country is now open to global construction firms, and boasts diversified investment sources.

Tanzania took third place in the Lamudi ranking with prices at 486.03 € per square meter. With an average price of 850.54 € per square meter, Kenya claimed sixth place on the list, following Mexico and Colombia. These figures are meticulously mined by Lamudi, a portal launched in 2013. The clearinghouse is a global property portal focusing exclusively on emerging markets. The Lamudi platform is available in 34 countries in Asia, the Middle East, Africa and Latin America, and includes in excess of 900,000 real estate listings throughout its global network.

Nigeria, with a per square meter price of 856.29 €, was followed closely by Kenya, according to Lamudi. Meanwhile Tunisia at 885.52 € appeared in the ninth slot, just ahead of Ghana (1,035.75 €), and Morocco (1,144.25 €). Rounding out the African countries featured, Uganda (1,597.22 €) occupied 15th place, ahead of Algeria (1,766.53 €), while Angola (3,965.52 €) closed the top 20 list.

Marrakech a top investment choice

Target cities to watch in the emerging luxury real estate market include Marrakech, Morocco. Marrakech holds strong growth prospects, favorable political stability, and an enticing environment for foreigners. Marrakech was recently named by Financial Times property experts as a top investment choice for 2014.

Lamudi’s focus on raw price may not be a representation of true property values. While luxury real estate property values in Morocco may be nearly four times those of Ethiopia, both are relatively cheap on a global scale, especially with regard to developed countries. For this reason, other criteria such as governmental and economic stability, environmental quality, and effectiveness of law enforcement may be more important determining factors than the price of land when comparing the featured countries for the purpose of luxury real estate investment. Furthermore, the unpredictable political climate and economic instability in these areas guarantees that these prices will fluctuate dramatically in relatively short periods of time.

Read more