Born and raised in the United Arab Emirates, a country known for its rapid modernization and rich natural ecosystems, Al Mubarak has been deeply influenced by the juxtaposition of progress and preservation. Her educational background, including studies abroad, equipped her with a global perspective on environmental challenges and solutions, setting the stage for her eventual return to the UAE to spearhead its conservation efforts.

Al Mubarak’s nomination as the Director General of the Environment Agency – Abu Dhabi (EAD) marked a significant milestone in her career and the agency’s history. Under her leadership, the EAD has embarked on ambitious projects aimed at protecting the emirate’s biodiversity, addressing climate change, and promoting sustainable development. Her appointment to this critical role reflects not only her expertise and commitment to environmental stewardship but also the UAE’s broader commitment to elevating women to leadership positions in sectors traditionally dominated by men.

One of the core missions of Al Mubarak’s tenure at EAD has been to reconcile economic development with environmental sustainability. Abu Dhabi, as part of the oil-rich UAE, faces unique challenges in balancing its economic backbone with the need to preserve its natural heritage and mitigate climate impacts. Al Mubarak has navigated these waters by promoting innovative conservation projects, such as the reintroduction of native species and the establishment of protected marine and terrestrial areas. She has also been a vocal advocate for renewable energy and reducing carbon emissions, aligning with the UAE’s vision to diversify its energy sources.

Successes and Controversies

Her successes are numerous and varied, ranging from tangible conservation victories, such as the significant increase in the population of the once-endangered Arabian Oryx, to strategic achievements like enhancing Abu Dhabi’s international environmental reputation. These successes underscore her ability to leverage her role for broad, impactful environmental gains.

Al Mubarak’s career has not been without controversy, a common trait among those leading change in complex fields. Her initiatives, especially those pushing for significant shifts in policy or practice, have sometimes faced resistance from traditional sectors accustomed to the status quo. However, her approach—grounded in science, diplomacy, and a genuine dialogue with all stakeholders—has often turned skepticism into collaboration.

Challenges remain, as with any leadership position in a field as dynamic and urgent as environmental conservation. Climate change, habitat loss, and biodiversity decline are global issues that require local actions to be effectively addressed. Al Mubarak’s perspective, shaped by her years of experience and the unique position of Abu Dhabi within the global environmental context, remains focused on innovation, collaboration, and a steadfast belief in the possibility of positive change.

Razan Al Mubarak’s biography is not just a testament to her personal achievements but also a reflection of the evolving role of leadership in environmental conservation. Her journey from a passionate student of the environment to the Director General of the EAD encapsulates a broader narrative of progress, challenge, and hope for a sustainable future. Through her work, Al Mubarak continues to inspire not just immediate action but a generational shift towards a more sustainable and equitable planet.

Photos : razanalmubarak.com

Sheikha Al-Mayassa has said that their goal is to develop a cultural ecosystem in Qatar that encompasses museums, exhibition galleries, an ambitious public art program, schools, film, photography and performing arts festivals, events, spaces for emerging creatives and fashion professionals and of design. She said, “We know that culture and the creative industries are key drivers of economic growth, both in Qatar and globally. And another of our priorities, closely related to the development of a cultural ecosystem, is to help introduce Qatar to other nations and cultures and to welcome people from those countries. We encourage creativity and intercultural understanding.”

Sheikha Al-Mayassa has said that their goal is to develop a cultural ecosystem in Qatar that encompasses museums, exhibition galleries, an ambitious public art program, schools, film, photography and performing arts festivals, events, spaces for emerging creatives and fashion professionals and of design. She said, “We know that culture and the creative industries are key drivers of economic growth, both in Qatar and globally. And another of our priorities, closely related to the development of a cultural ecosystem, is to help introduce Qatar to other nations and cultures and to welcome people from those countries. We encourage creativity and intercultural understanding.” North Field South is aiming to use the highest standards of extraction to reduce the greenhouse gas emissions associated with the project. The processing plant will be connected to Qatar’s electricity grid, meaning it will be powered in-part by renewable energy, mostly from the 800MW Al Kharsaah solar plant and the QatarEnergy solar plant currently under construction. Along with this, native CO

North Field South is aiming to use the highest standards of extraction to reduce the greenhouse gas emissions associated with the project. The processing plant will be connected to Qatar’s electricity grid, meaning it will be powered in-part by renewable energy, mostly from the 800MW Al Kharsaah solar plant and the QatarEnergy solar plant currently under construction. Along with this, native CO

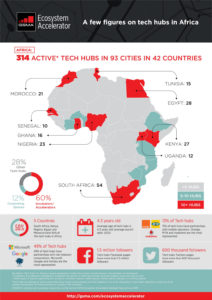

It is easy to conclude that the continent is already a hotbed for tech startups, especially as economic forecasts predict a record year for tech in Africa in 2022, with the possibility of total investments into startups reaching more than $7 billion. But while there is more money flowing into more companies than ever before, Africa’s record of scaling up these companies or even sustaining them, is poor.

It is easy to conclude that the continent is already a hotbed for tech startups, especially as economic forecasts predict a record year for tech in Africa in 2022, with the possibility of total investments into startups reaching more than $7 billion. But while there is more money flowing into more companies than ever before, Africa’s record of scaling up these companies or even sustaining them, is poor.