JOHANNESBURG (Reuters) – Investment company Allan Gray said on Friday its 16 percent stake in Net1 allowed it to call a shareholders’ meeting over the payment technology provider’s handling of the scandal over a South African welfare contract.

South Africa’s Constitutional Court was set to rule on Friday in a case concerning the unlawful tender of a contract to Net1 unit Cash Paymaster Services (CPS) to manage welfare benefits to 17 million people.

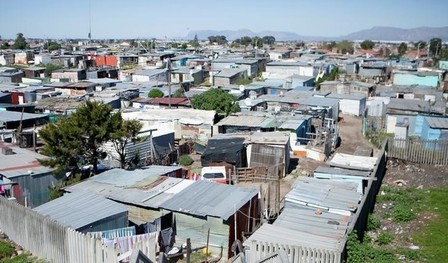

The stakes are high as the welfare system is a lifeline for South Africa’s most vulnerable and includes more than 11 million child support grants, many of whom would go hungry without the monthly payment.

Allan Gray could push for the removal of the Net1 board, Chief Investment Officer Andrew Lapping was quoted in the Business Day newspaper.

“Sixteen percent allows us to call a shareholders’ meeting,” Allan Gray Chief Operating Officer Rob Dower told Talk Radio 702.

Friday’s looming judgment by the country’s top court stems from a case brought by applicants who want it to take oversight of a new contract.

South African President Jacob Zuma said in parliament on Thursday there was no “crisis”. Earlier this week the country’s chief justice placed the blame for the debacle squarely on the shoulders of Social Development Minister Bathabile Dlamini, calling her inaction incomprehensible.

The creation of a welfare safety net which supports one in three South Africans has been one of the signature achievements of the ruling African National Congress (ANC), in power since the end of white apartheid rule in 1994.

The chaos in South Africa’s social security agency comes three years after the Constitutional Court ruled that the tender won by CPS was illegal.

The government was given time until April 1 to take responsibility for social service payments or find a new provider, but it has so far failed to do so, raising concerns that grants may not be paid on time next month.

(Reporting by Ed Stoddard; Editing by James Macharia)