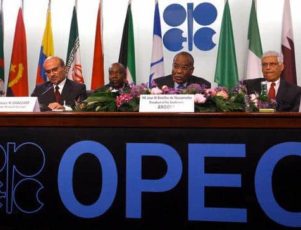

LONDON (Reuters) – OPEC oil output fell in March to an 11-month low due to declining Angolan exports, Libyan outages and a further slide in Venezuelan output, a Reuters survey found, sending compliance with a supply-cutting deal to another record.

The Organization of the Petroleum Exporting Countries pumped 32.19 million barrels per day last month, the survey found, down 90,000 bpd from February. The March total is the lowest since April 2017, according to Reuters surveys.

OPEC is reducing output by about 1.2 million bpd as part of a deal with Russia and other non-OPEC producers to get rid of excess supply. The pact started in January 2017 and runs until the end of 2018.

Adherence by producers in the deal rose to 159 percent of agreed cuts from 154 percent in February, the survey found. There was no sign that other producers had boosted output to cash in on higher prices or to compensate for the Venezuelan decline.

Oil has topped $71 a barrel this year for the first time since 2014, and was trading above $67 on Wednesday. Still, OPEC says supply restraints should be maintained to ensure the end of a glut that had built up since 2014.

In March, the biggest decrease in supply came from Angola, which exported 48 cargoes, two fewer than in the same month of 2017. Natural declines at some fields are weighing on output.

Production in Libya, which remains unstable due to unrest, slipped because of stoppages at two fields, El Feel and El Sharara, setting back 2018’s partial recovery in output.

And production fell further in Venezuela, where the oil industry is starved of funds because of an economic crisis. Output dropped to 1.56 million bpd in March, the survey found, a new long-term low.

Output in OPEC’s largest producer, Saudi Arabia, dropped by 40,000 bpd from February’s revised level, even further below the kingdom’s target.

OPEC’s No. 2 producer, Iraq, pumped more. Exports from the south, the outlet for most of the country’s crude, rose despite maintenance at a loading terminal. Exports declined from the north but domestic crude use increased.

Among others with higher output, the biggest rise came from the United Arab Emirates, where production had dropped in February due to maintenance. Even so, the UAE is still pumping below its OPEC target and showing higher compliance than in 2017.

Output climbed in Qatar, after a dip in February that sources attributed to maintenance. Nigeria also pumped at a higher level, extending a run of more stable supply from Africa’s top exporter.

Nigeria and Libya were originally exempt from cutting supply because their output had been curbed by conflict and unrest. For 2018, both told OPEC that output would not exceed 2017 levels.

OPEC has an implied production target for 2018 of 32.73 million bpd, based on cutbacks detailed in late 2016 and taking into account changes of membership since, plus Nigeria and Libya’s expectations of 2018 output.

According to the survey, OPEC pumped about 540,000 bpd below this implied target in March, not least because of the involuntary decline in Venezuela.

The Reuters survey is based on shipping data provided by external sources, Thomson Reuters flows data and information provided by sources at oil companies, OPEC and consulting firms.

(By Alex Lawler; Additional reporting by Rania El Gamal in Dubai; Editing by Dale Hudson)