After being postponed for a year due to pandemic, Expo 2020 is finally set to begin in Dubai, with nearly every country on the African continent represented both individually and through a dedicated pavilion for the African Union.

No expenses spared to make Dubai’s Expo 2020 a success

After being postponed for a year due to the Covid-19 pandemic, Expo 2020 is finally set to begin on the 1st of October 2021, with Dubai hosting the Universal Exhibition. For the first time in the 170 year history of World Expos, nearly every country on the African continent will be represented, both individually and through a dedicated pavilion for the African Union. Architecturally alone the event will be spectacular, with Morocco’s pavilion being a vertical earthen village that offers views of the whole event from it’s rooftop. With an estimated allocated budget of $8.7 billion, it is not a cheap event to host, but if successful it has been expected to generate up to US$17.7 billion in revenue for Dubai. Aside from the potential economic benefit, for the United Arab Emirates hosting the expo is a way to position themselves as a country of influence on the international scene, and further their political and economic presence on the continent of Africa.

A unified Africa presents a new image of the continent

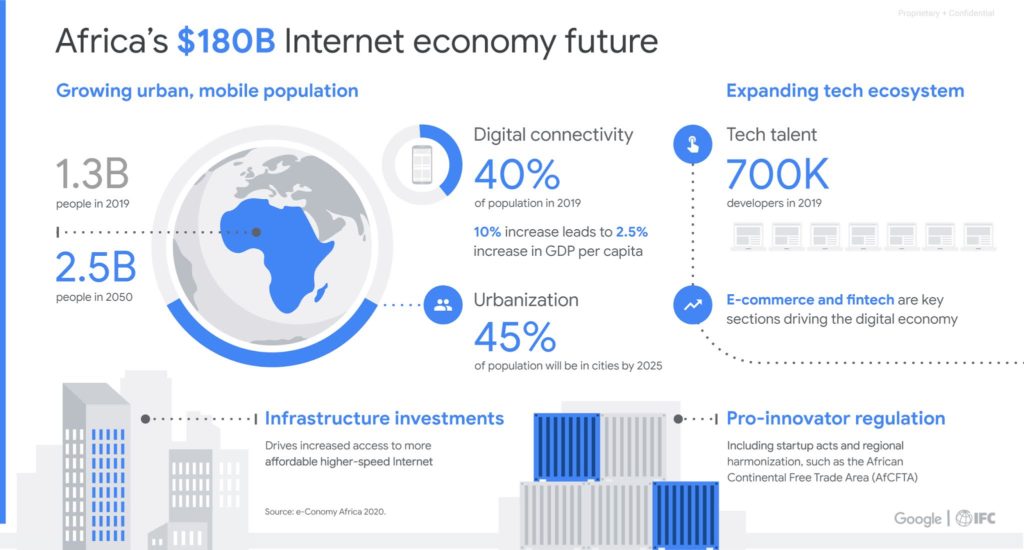

For the continent too the exposition is an opportunity, as a myriad of countries wish to deepen their ties with Africa. With it’s Agenda 2063 – a 50-year plan to see an “integrated, prosperous and peaceful Africa, driven by its own citizens” – the African Union is ready to use the expo to show that the continent represents a dynamic force in the international arena. Aspiring to an Africa with no borders, whose people see themselves as Africans first, united in common heritage, culture and values the African Union pavilion will highlight Africa’s potential and ambitions, showing a new face of the continent that is exciting, young and modern.

The highlights of the continent on display

Within each carefully curated pavilion, over 40 countries on the continent will showcase to the world what they can offer:

Investment Opportunities

Some countries, like the Democratic Republic of the Congo will showcase the resources of the country. To attract investors the Congolese pavilion will highlight the country’s 80 million hectares of arable land, and the energy-production potential of the Congo River. Likewise Zimbabwe’s pavilion will showcase a destination filled with mining, construction and agriculture opportunities. In the Ethiopian pavilion conveyor belts will display locally-made products, while Nigeria’s ‘Opportunity City’ will put the country’s booming creative and technology sectors at the forefront for visitors to see.

Tourism

For many countries the Expo offers a chance to sell the country as a tourism destination. With the recent rehabilitation of Benin’s cultural sites, the country wants to revitalize its tourism industry. In fact, standing out as a tourism destination will be the challenge at Expo 2020. Heavyweights in tourism like Egypt will deploy pyramids, hieroglyphic signs and genuine antique pharaoh statues, while Nigeria will show visitors around it’s untouched destinations on a virtual reality Eco-tour.

Culture

Along with highlighting the economic opportunities, African countries will be reminding the world of the wealth of culture on the continent. Entering the Ethiopian pavilion will see visitors coming face to face with a replica of ‘Lucy,’ the world’s oldest human fossil, while in the Nigerian pavilion the ‘Nollywood’ film scene will be highlighted. Meanwhile in the Kenyan pavilion is the opportunity to meet the 44 different tribes that make up the country, and visitors can leave with a Kenyan name and digital copy of their own Kenyan passport.

Enticing investment into the continent remains a challenge

Before the Covid-19 pandemic hit the world, Africa as a continent had seen 25 years of continuous economic growth. Despite this, the bottom half of the global Human Development Index is dominated by African countries, and the continent’s lack of infrastructure remains a barrier to international trade. This makes international investors wary, further holding the continent back. This is acknowledged by Eugene Manga Manga, the Democratic Republic of the Congo’s General Commissioner for Expo 2020. He has stated that, “The continent has a lot of difficulties, but it has also started to develop.” With rich natural resources and a youthful, entrepreneurial population, the continent does indeed have a lot to offer, and Expo 2020 may be the perfect chance to remind the rest of the world of this fact.

Photos : expo2020dubai.com/