10 countries see improvement in their political systems and Mauritius, Cabo Verde and Botswana are the top rated.

Africa has seen scant improvement in national governance in recent years and more than a third of its 21 nations saw declines in the quality of their civic systems, according to a comprehensive index established by a Sudanese philanthropist.

The overall average for the continent increased by only 0.2 points to 50.1 out of a total of 100 possible points between 2011 and 2014, according to the Ibrahim Index of African Governance. The index also showed a decline of more than two points in the area of economic opportunity.

Twenty-one countries, including five of the top ten nations, have experienced deterioration of government performance since 2011 while only 10 countries registered improvement.

The index revealed significant gaps. Mauritius was the top-rated nation with a score of 79.9; war-torn Somalia had the lowest with a score of only 8.5. Regionally, Southern Africa had the highest rating for governance at 58.9. Central Africa had the lowest, 40.9.

Index assesses safety, business climate

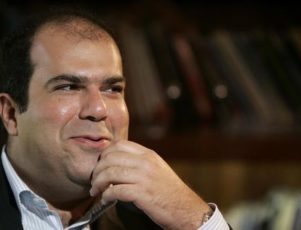

The annual index is produced by the foundation of Sudanese telecom billionaire Mohamed Ibrahim, who is known for fighting corruption. Launched in 2006, it evaluates governance in each of 54 African countries based on 93 indicators that fall into four broad categories: safety and rule of law, human development, participation and human rights, and sustainable economic opportunity.

The top 10 countries, with their ratings in parentheses, are: Mauritius (79.9), Cabo Verde (74.5) Botswana (74.2), South Africa (73), Namibia (70.4), Seychelles (70.3), Ghana (67.3), Tunisia (66.9), Senegal (62.4), and Lesotho (61.1).

Mauritius, Cabo Verde, Botswana, Seychelles and Ghana, saw ratings declines while the other five countries improved.

Other countries that showed improvement were: Ivory Coast (48.3), Morocco (57.6), Rwanda (60.7), Senegal (62.4), and Zimbabwe (40.4).

Ivory Coast shows most improvement

Ivory Coast was most improved with an increase of 8.4 points. The West African nation is emerging from years of civil war that was triggered by a disputed election in 2010 and left an estimated 3,000 people dead. Ivory Coast held successful democratic elections for president in 2015.

War-torn South Sudan, Mali and the Central African Republic posted the steepest drops in the ratings. South Sudan’s rating declined by 9.6 points to 19.9 out of 100. The Central African Republic’s rating decreased by 8.4 points to 24.9. Mali was down 8 points to a rating of 48.7.

Thousands have been killed or displaced in South Sudan as the government battled rebel forces since 2013. The United Nations has warned that nearly 25 percent of the population of South Sudan is in urgent need of food.

After years of civil unrest, Mali has been plagued by jihadist attacks targeting tourist locations. Islamist militants killed 20 hostages in November at a hotel in the capital of Bamako.

In the Central African Republic, hundreds have been killed and an estimated 35,000 people displaced since 2013, when a mostly Muslim group overthrew the government. Widespread accusations of human rights abuses by that group prompted formation of mostly Christian militias that have retaliated against Muslims.

Tanzania, Uganda among those with declines

These countries had also ratings declines of one point or more: Tanzania (56.7), Uganda (54.6), Mozambique (52.3), Gambia (50.5), Cameroon (45.9), Guinea-Bissau (35.7), and Libya (35.5).

Other countries whose ratings declined slightly (less than one point) were Benin (58.8), Malawi (56.7), Niger (48.4), Guinea (43.7), Equatorial Guinea (35.5), Eritrea (29.9).

Along with the Guinea-Bissau, Equatorial Guinea, Libya, Eritrea, Central African Republic, South Sudan, the bottom 10 included: the Democratic Republic of the Congo (33.9), Chad (32.8), Sudan (28.3), and last-place Somalia (8.5).

The index also revealed striking differences across regions of the continent, from an average low of 40.9 points in Central Africa to a high of 58.9 points in Southern Africa. East Africa scored 44.3, North Africa 51.2 and West Africa 52.4 In addition to being the lowest rated, Central Africa was the only region where governance deteriorated, according to the index.

Business environment declines

In its four categories, the index showed that the sustainable economic opportunity indicators had the lowest average score for the continent, 43.2 points, a decline of 0.7 points from 2011. In particular, the index showed a decline of 2.5 points in “business environment,” which included a drop of 11 points in the sub-category of soundness of banks.

Four countries bucked the trend, showing gains of 5 points or more on economic opportunity ratings: Morocco, Togo, Kenya and Democratic Republic of Congo.

Ibrahim said that while the continent has made significant progress in the past 15 years, the latest results are cause for concern.

The 2015 index “shows that recent progress in other key areas on the continent has either stalled or reversed, and that some key countries seem to be faltering,” he said. “This is a warning sign for all of us. Only shared and sustained improvements across all areas of governance will deliver the future that Africans deserve and demand.”

Read more