Twelve African countries sign multilateral agreement to counter tax abuse, which costs the continent an estimated $50 billion annually.

Kenya and Senegal have joined 10 other African countries in signing an international agreement designed to reduce tax evasion.

The multilateral convention enables cooperation among nations, including exchange of information about tax evaders and assistance in collecting taxes from them.

African nations lose an estimated $50 billion per year to illegal financial transfers, including tax avoidance, according to a 2015 report by the African Union and UN Economic Commission for Africa. In comparison, Africa received about $29 billion in foreign aid in 2013.

The tax evasion problem is particularly acute for poorer countries that do not have tools to fight sophisticated schemes by large multinational companies. The report and aid groups have noted that these billions of dollars might otherwise be used to develop services and infrastructure on the continent.

Multinational companies blamed

“Africa is hemorrhaging billions of dollars because multinational companies are cheating African governments out of vital revenues by not paying their fair share in taxes. If this tax revenue were invested in education and health care, societies and economies would further flourish,” said Winnie Byanyima, executive director of Oxfam International.

The Multilateral Convention on Mutual Administrative Assistance in Tax Matters is one tool to fight large-scale tax evasions. It was developed by the Council of Europe and the Organization for Economic Cooperation and Development in 1988 and updated in 2010.

Parties to the agreement cooperate by providing financial information to other party countries on request, performing tax examinations and assisting with recovery of tax dollars.

Twelve African nations sign agreement

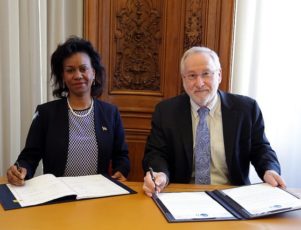

Kenya and Senegal signed the agreement in February. Other African parties to the convention are Morocco, Gabon, Cameroon, Mauritius, Uganda, Ghana, Nigeria, South Africa, Tunisia and Seychelles. Globally, a total of 94 countries have signed the convention.

Kenya also recently passed a law that prevents companies from using a common tax-avoidance practice called “transfer pricing” or “trade mispricing.”

Using this practice, companies allocate their costs to subsidiaries in high-tax jurisdictions in order to pay most of their taxes at the lower rate while moving their profits to jurisdictions where they pay little or no tax.

For example, the African Union study described a South African case in which a multinational corporation claimed that a large part of its business was located in the United Kingdom and Switzerland, with relatively low tax rates.

On investigation, South African officials found the European branches had only a few staff while the company conducted most of its business in South Africa. The scheme had enabled the company to avoid $2 billion in taxes, which the South African government reclaimed.

Invoices misstate value

Other practices are “under-invoicing” or declaring a low value on exports to minimize profits on paper and “over-invoicing” by declaring a high cost on imports.

For example, Mozambique records showed an export of 260,385 cubic meters of timber was exported to China in 2012 while records in China show 450,000 cubic meters were imported from Mozambique that year, according to the report.

Another study, by Global Financial Integrity (GFI), found high rates of over and under-invoicing in Kenya, Ghana, Mozambique, Tanzania and Uganda in the decade leading up to 2011.

Kenya, Tanzania see high losses

GFI said Kenya had an estimated $10 billion and Uganda $813 million in under-invoicing. At the same time, Tanzania had $10 billion to over-invoicing. Ghana had more than $14 million for the decade in misstated invoices and Mozambique more than $5 million.

The African Union report said illicit financial outflows from Africa have more than doubled since 2001, from $20 billion to the current $50 billion. The report said African nations lost about $850 billion to illegal transfers between 1970 and 2008, including $218 billion from Nigeria, $105 billion from Egypt and $82 billion from South Africa.

The report said mispricing occurs in a number of sectors, including mineral production in the Democratic Republic of the Congo and South Africa, crude oil exports from Nigeria, and timber sales from Mozambique and Liberia.

Corporations, organized crime cited

Thabo Mbeki, the former president of South Africa who chaired that panel that produced the report said large corporations were the main tax abusers aided by corrupt officials and weak governance.

“The information available to us has convinced our panel that large commercial corporations are the biggest culprits of illicit outflows, followed by organized crime,” Mbeki said.

African and non-African governments as well as oil, mining, banking, legal and accounting firms were involved in tax avoidance schemes, according to the study.

It found that 38 percent of the outflows from the continent originated in West African and 28 percent in North Africa. Southern, Central and East Africa each accounted for about 10 percent.

While significant to the continent, Africa’s losses are a small share of the illicit outflows globally, about six percent of an estimated $1 trillion between 2007 and 2009.