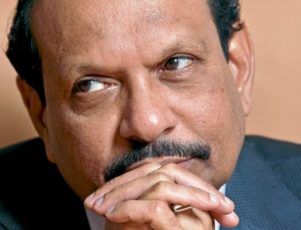

Billionaire M.A. Yusuff Ali has built the global retail empire Lulu Group from his base in Abu Dhabi.

M.A. Yusuff Ali, who has built a global empire of supermarkets, shopping malls and grocery stores, will be at the top of just about any list of the most powerful Indians doing business in the Gulf.

The managing director of the retail giant Lulu Group, based in Abu Dhabi, started in a small, isolated office in a barren desert 40 years ago and went on to build an international powerhouse that employs more than 35,000 people in 31 countries, most of them in the Middle East and Africa.

With a net worth of $3.1 billion, the Kerala-born businessman is number 24 on Forbes’ list of India’s 100 Richest People. He’s repeatedly been named the most powerful Indian in the Gulf by publications including Arabian Business and DNA India.

More retail outlets to open

Lulu Group now operates 121 retail outlets that cover a total of 22.5 million square feet. In January, it opened an outlet in Dammam, Lulu’s sixth in Saudi Arabia, and another in Juffair, a suburb of Manama, its fifth in Bahrain.

Yusuff Ali also has announced plans to open more hypermarkets and malls in Saudi Arabia, Egypt, Bahrain and Malaysia.

The company, with annual revenue of $5.5 billion, is also venturing into the hospitality business, notably with the development of a hotel at the former Scotland Yard in London.

Lulu opened its first hypermarket in Dubai in 2000. The stores cater to multi-ethnic shoppers in the region with an international mix of both products and staff.

In addition to its retail chain, Lulu Group engages in manufacturing, import-export, and business services.

Scotland Yard will become a hotel

Yusuff Ali has recently gone into the hospitality business, making headlines last summer with a $171 million deal to develop the former Scotland Yard headquarters in London. The new hospitality arm of Lulu, Twenty14 Holdings, will open the Great Scotland Yard Hotel early in 2017.

It was his second London investment. In 2014, he purchased for $85 million a 10 percent interest in East India Company, the historic trading company that led British colonization of India in the 18th and 19th centuries.

Yusuff Ali started small, moving from India to Abu Dhabi to join the family business in 1973 and finding challenging conditions there.

“It was a very hard time initially. Abu Dhabi was all of two roads; none of the glitz and glamour that you associate UAE with today. The entire country was just coming terms with the discovery of oil,’’ he said.

Company employs 35,000

In all, Lulu employs more than 35,000 people from 37 different countries.

It has operations in the United Arab Emirates, Oman, Qatar, Kuwait, Saudi Arabia, Bahrain, Yemen, Egypt, Kenya, Benin, Tanzania, Senegal, Uganda, Nigeria, Ghana, Ivory Coast, South Africa, Mozambique, Cameroon, Togo, and Gambia as well as India, China, Hong Kong, Indonesia, Thailand, Vietnam, Malaysia, Brazil, Turkey and the United Kingdom.

Yusuff Ali is also active in business and charitable affairs in the Gulf and in India.

He cites as a matter of great pride that he is the first expatriate to be elected to the board of the Abu Dhabi Chamber of Commerce & Industry. In 2014, he was re-elected to the board for a third term.

He also has received the Padma Sri and Pravasi Bharatiya Award, the Indian government’s highest honor for a non-resident Indian, as well as the Asian Business Award for Best Business Leader and Arabian Business Award.

He has donated to a variety of charitable causes in both India and the Gulf. He also helped organize relief from the Gulf for multiple natural disasters in India, including the Lathur and Gujara earthquakes.

Business confidence and popular support for the incumbent government have also dropped.

Business confidence and popular support for the incumbent government have also dropped.