By Mfuneko Toyana

JOHANNESBURG (Reuters) – Fitch is very concerned that South Africa’s economic and political situation is not improving, the country’s second largest federation of trade unions said on Tuesday after it held talks with the ratings agency.

In April, Fitch cut South Africa’s debt to subinvestment, citing the recent cabinet reshuffle, when President Zuma fired his third finance minister in two years and which it feared would weaken standards of governance and public finances.

Firing Pravin Gordhan while he was abroad on an investor roadshow and the subsequent sovereign downgrade rattled local markets and investors worldwide.

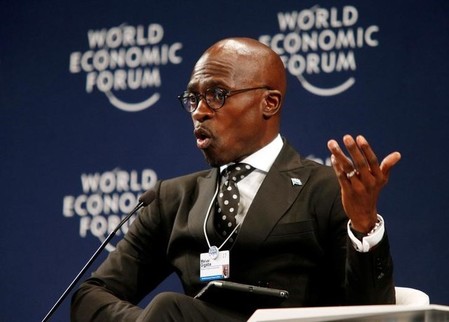

The Federation of Unions of South Africa’s (FEDUSA) General Secretary Dennis George told Reuters that Fitch said it was also worried about the lack of progress in reforming state firms.

“They wanted to know how we see the future and what we see happening at the (ruling African National Congress) ANC elective conference in December,” said George, who was meant to be part of the contingent accompanying Gordhan overseas on the roadshow.

The ruling ANC elects its next leader, who will contest national polls in 2019. The cabinet purge that saw Gordhan removed is seen by analysts as part of a wider power-struggle between factions in the party jostling for top positions and control of state-owned entities (SOE).

“Fitch are very concerned about what is happening in the country and the fact that things are not getting better, they’re getting worse,’ George said.

“They also agreed with us that we can’t keep bailing out the state-owned companies,” he said.

Government guarantees to state firms are set to increase to nearly 500 billion rand ($38 billion) in 2017, about a quarter of the total debt, according to the treasury, which says the firms represent a significant risk to already stretched finances.

When Fitch downgraded the rating, it said the reshuffle was likely to “undermine progress in SOE governance”, raising the risk that the firms’ debt could migrate onto the government’s balance sheet.

Fitch was not immediately available for comment.

(Editing by Louise Ireland)