Youssef Omaïs continues to grow his Senegalese agribusiness – Patisen – after 35 years of success.

Youssef Omaïs is unlikely to be a name that is familiar to most people, as he is not a man who courts fame or accolades. However, as the CEO of Patisen, Omaïs heads up a group that provides many of the most popular food brands in Africa.

Omaïs is of Lebanese heritage but is Senegalese born and raised. This firm connection to the country, in which he launched his business, has been integral to earning the respect of his peers but also to ensuring that Patisen has continued to grow year on year.

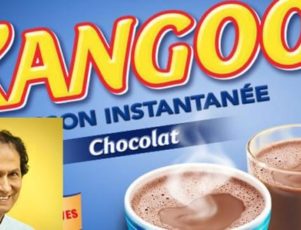

Patisen was launched in Senegal, in 1981, and aimed to provide the people of the country and others in West Africa with a range of affordable food products. Patisen did not just set out to market recognizable brands, but to take on the international giant Nestlé, in one of its strongest markets. Patisen has even been accused of copying Nestlé with its color scheme and product names. Omaïs casually dismisses such complaints, insisting that the truth behind his success in Senegal and the wider African market is down to two key tenets.

Firstly, there is the fact that Patisen is entirely Senegalese owned and run. Every position within the company is filled by a local person, which must not only foster local support but also keeps overhead costs lower than rivals who employ European staff. Omaïs also states that it is simply a matter of knowing your customers saying, “We know we address consumers, while most foreign manufacturers are disconnected from the ground.”

The Growth of a Giant

This connection to the local markets enabled Omaïs to rapidly turn Patisen‘s range of spreads, chocolate drinks and bouillon cubes into hugely popular and recognizable names. The Chocolion brand of chocolate spread is one of the most popular in Senegal and export markets to the rest of West Africa and even into Europe have continued to increase.

In 2011, Omaïs said that the company’s export business accounted for “10% to 15% of our sales” but that he wanted to “increase this to 85%” as he aims to become West and Central Africa’s first choice.

In the same year, Youssef Omaïs was announced as the “Best Entrepreneur of the Year” for his previous year’s work, at Senegal’s prestigious, annual Sedar awards. This award sits alongside his title of “Knight of Agricultural Merit”, which was given to him by the department of agriculture in Senegal for his contribution to the nation’s economy and job production.

While individual recognition might drive some business figures, Omaïs is a quiet man who does not court the limelight. Rather, his focus is entirely on turning Patisen into an even greater presence within the African market. In 2011, Omaïs secured investment of $14.3 million from the International Finance Corporation, of which $3.2 million was equity.

Omaïs said that he believed the money would “transform us into a regional champion.”

The investment evidently worked, as by 2013, Patisen was employing over 3,000 local people and had a turnover of $143 million. The quietly spoken CEO continued to bolster his local reputation, by using some of his organization’s money to repair and re-open the abandoned Dakar Market, which had fallen into disrepair after numerous fires. Such moves resonate with local communities and make Patisen brands even more marketable.

Omaïs looks to the future

While the heart of Omaïs’s company lies in Senegal, his aspirations extend far beyond his home nation. Patisen is already exporting to 20 different countries, and it is gradually making its mark in Central Africa; but Omaïs wants to spread across the entire continent.

At 61 years of age, Omaïs believes that moving into new lines of food produce will allow his company to become the “undisputed leader in Africa”.

Patisen will open up a new production plant near Dakar in the second half of this year, as it moves into the manufacturing of mayonnaise. Within a year, Omaïs expects the plant to be producing 25,000 tons of the condiment for a turnover of over $42 million.

Omaïs summarizes the ethos of his company goals by saying, “We work every day to contribute to the well-being of millions of people who use our products.”

Key attractions among the static displays were Dassault Aviation’s Rafale and a long-range Falcon 900LX which required a six-man exhibition team to staff the aircraft and show off its capabilities. Also prominently displayed was a U.S. Air Force C-130J Hercules, from the Ramstein Air Base in Germany. This Behemoth stood out as a symbol of partnership whilst promoting regional security throughout the African continent.

Key attractions among the static displays were Dassault Aviation’s Rafale and a long-range Falcon 900LX which required a six-man exhibition team to staff the aircraft and show off its capabilities. Also prominently displayed was a U.S. Air Force C-130J Hercules, from the Ramstein Air Base in Germany. This Behemoth stood out as a symbol of partnership whilst promoting regional security throughout the African continent.

The end of the civil war in 2003 marked Sirleaf’s return to the country and her rise to real power and prominence. A transitional government was established with Sirleaf serving as Head of the Governance Reform Commission. She then stood for the presidency in the hotly contested general election of 2005. Sirleaf managed to best the popular candidate, footballer George Weah, and secure the leadership. Sirleaf later went on to win a second term in office in 2011. She accepted the Nobel Peace Prize just four days before announcing running for a second term, the timing of which was heavily criticized by her opponents.

The end of the civil war in 2003 marked Sirleaf’s return to the country and her rise to real power and prominence. A transitional government was established with Sirleaf serving as Head of the Governance Reform Commission. She then stood for the presidency in the hotly contested general election of 2005. Sirleaf managed to best the popular candidate, footballer George Weah, and secure the leadership. Sirleaf later went on to win a second term in office in 2011. She accepted the Nobel Peace Prize just four days before announcing running for a second term, the timing of which was heavily criticized by her opponents.